March 28, 2023

From the desk of Kara Murphy1, CFA

Is Commercial Real Estate the Next Shoe to Fall?

After many years of accelerated growth backed by low-interest rates, easy credit, and competitive lending, commercial real estate has become the latest area of concern for investors. Read more about how unfolding events could impact banks, property values, and individual investors in this week’s Markets in a Minute.

After many years of accelerated growth backed by low-interest rates, easy credit, and competitive lending, commercial real estate has become the latest area of concern for investors. Beat up by rising interest rates, hybrid working environments, and tightening lending standards—real estate loans backing office buildings are particularly in the cross hairs, as are the regional banks that hold a large percentage of those loans. How could these developments impact banks, property values, and individual investors? Let’s discuss in this week’s Markets in a Minute.

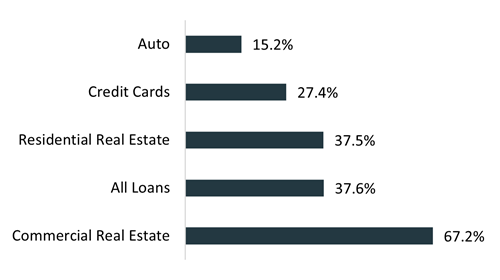

Share of Loans Held By Small Domestic Banks, By Select Sectors

Many small banks have long focused their efforts on commercial real estate, which can include anything from warehouses to rental apartments to retail space and medical offices. Bank loans are often collateralized by the properties themselves, and can be paid off over many years. While many of these types of real estate have held up well, office space has been particularly hard hit of late. Many companies are utilizing much less office space than they have historically, thanks to a push toward hybrid and remote work during Covid. This trend has left many office buildings full of empty floors, particularly in larger cities, leaving nearly 17% of all office space vacant across the country.

With less demand for office space, vacancies are up, and rents are beginning to decline. The national average full-service equivalents listing rate for office space was $38.28 per square foot in February, down 1.6% year-over-year, driving down overall revenues for property owners. This comes at a difficult time as interest rates have soared. Many owners of commercial buildings have loans with floating rates—so as interest rates increase, so do interest payments. That, in turn, makes the buildings less valuable.

What’s the Impact on Banks?

Almost 80% of commercial real estate loans are made and held by banks, with a significant portion of those held by smaller banks with less than $250 billion in assets.

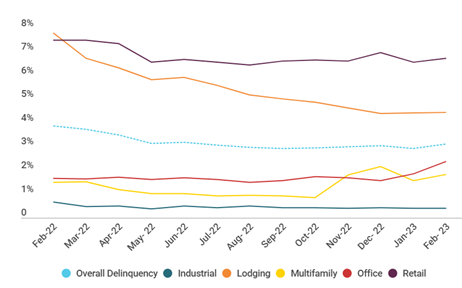

While commercial property owners are under stress from lower revenues and higher interest expenses, they are still paying their bills. Delinquency rates on commercial real estate loans have held steady over the last couple of years. However, it’s worth noting that office-related delinquencies have begun to tick up from historically low levels.

Delinquency Rate by Property Type, Month Over Month

These relatively mild delinquency numbers don’t tell the whole story. Several high-profile companies have defaulted on their loans for office buildings, including Brookfield Asset Management and PIMCO. Those defaults reflect a growing consensus that workers may never embrace the traditional office to the same extent they did before Covid.

Owners of office buildings are likely to face additional stress with 17% of the value of all loans on office buildings maturing in the next three years. At that point, those loans will likely need to be refinanced and move from a low interest rate to a significantly higher one.

Several measures put in place in the wake of the global financial crisis are likely to help ease banks’ burdens should these loans turn sour. It is relatively well known that, in the wake of 2007, regulators began requiring banks to hold much more capital. By holding more excess cash, banks are able to accommodate a greater number of borrowers who may not be able to keep up with interest payments. That is exactly the type of scenario that regulators were hoping to guard against.

A less well-known program allows banks to hold loans at their original value, rather than marking them down should conditions worsen. The purpose of the rule change was to give banks and borrowers time to work through challenges, which could provide just the extra breathing room needed.

What This Means for Individual Investors

With all signs pointing to the Federal Reserve continuing to raise rates to combat inflation and slow the economy, we’ll likely see lending standards tighten across the board, especially among regional and local banks. It’s also possible that this pullback trickles down to individuals, making it more difficult to secure auto or consumer loans. While these developments in the commercial real estate sector can capture headlines, they should not shake your commitment to your investment plan. A well diversified portfolio can help navigate potential turbulence.

Invest wisely and live richly,

Kara

1 Kara Murphy, CFA is not affiliated with or an employee of Wealth Preservations Solutions, LLC., or Kestra Advisory Services, LLC. Kara is affiliated with Kestra Investment Management, LLC, an investment adviser registered with the Securities and Exchange Commission. Kestra IM is an affiliate of Kestra Holdings. The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice.