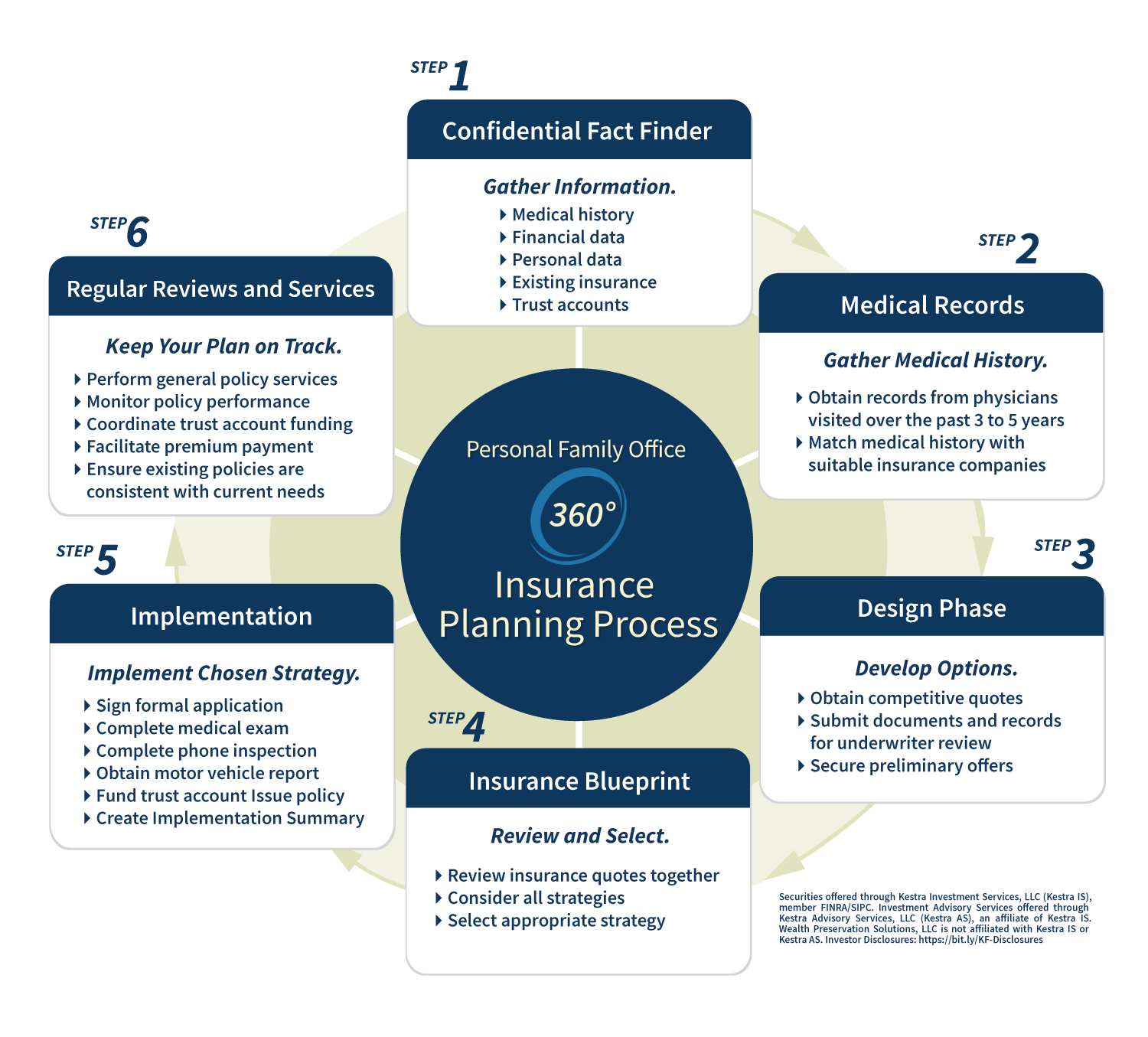

Our Insurance Planning Process

We have no allegiance to any insurance company. Whether you need life, disability, long term care or any combination thereof, we work to negotiate extremely competitive rates from financially sound insurance companies, using our extensive experience and contacts.

-

1Confidential Fact Finder

Gather Information

- Medical history

- Financial data

- Personal data

- Existing insurance

- Trust accounts

-

2Medical Records

Gather Medical History

- Obtain records from physicians visited over the past 3 to 5 years

- Match medical history with suitable insurance companies

-

3Design Phase

Develop options

- Obtain competitive quotes

- Submit documents and records for underwriter review

- Secure preliminary offers for review

-

4Insurance Blueprint

Review and Select

- Review insurance quotes together

- Consider all strategies

- Select appropriate strategy

-

5Implementation

Implement chosen strategy

- Sign formal application

- Complete medical exam

- Complete phone inspection

- Obtain motor vehicle report

- Fund trust account

- Issue policy

- Create Implementation Summary

-

6Regular Reviews and Services

Keep your plan on track

- Perform general policy services

- Monitor policy performance

- Coordinate trust account funding

- Facilitate premium payment

- Ensure existing policies are consistent with current needs