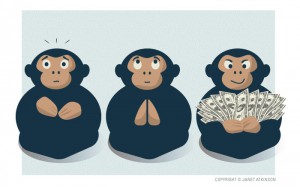

Illustration by Janet Atkinson

In 2008 and 2009, the market was down, stocks were down and the housing market had collapsed. Two major investment houses, among others, Lehman Brothers and Bear Stearns, were all but defunct. The news was bad everywhere. People generally believed that things would continue to deteriorate into a full-blown depression and that it would be crazy to consider investing in the market at that point. Few wanted to buy stocks. They were afraid that prices could go lower and of course they could. People were afraid of investing in the market without the validation of their peers and other market participants. This is the fear part of the cycle.

By mid 2013, the economy began improving. News about housing starts and manufacturing was getting a little bit better and the rate of unemployment was slowing. The stock market was beginning to rise. Most people were beginning to believe that the worst was over, at least for the foreseeable future, and that if things continued to improve, they might start to think about investing again. This is the hope part of the cycle.

As we head into 2014, the market has continued to improve, housing starts are healthier and unemployment is falling. Stocks continue to rise, people are getting excited, and newspapers and media commentators are declaring a bull market. Many are beginning to think: “Better invest now, before it’s too late. I don’t want to miss the market!” Many sold low and are now buying high! People are caught up in the greed cycle.

This behavior is the exact opposite of disciplined investing. The great investor, businessman and philanthropist, John Templeton, used to say: “Be greedy when others are fearful and fearful when others are greedy.” The irony is that nobody seems to want to buy stocks when they are down. Yet, most people would agree that getting any other quality goods on sale is desirable!

So, consider these tips to avoid the fear, hope and greed cycle:

• Think about investing in financial instruments the same way you would buy groceries, clothing, electronics or real estate.

• Remain alert for market drops to indicate an opportunity to buy quality stocks on sale.

• Think about buying on dips and adding to your portfolio each time the market experiences a temporary decline.

• Avoid the temptation to buy high, don’t overpay! Again, buy quality stocks on sale.

Learn about the Wealth Preservation Solutions Investment Planning Process.