Illustration by Janet Atkinson

The success of exiting a business depends greatly upon the mental perspective and preparation of an owner during the exit process. Business owners tend to fixate their thoughts only on running and growing their business. However, there is a tremendous amount of value in seeing the ‘big picture’ with your exit and thinking about the future and where you would like both the company, and yourself personally, to end up. The owner who is able to see the larger picture, and understands that stepping out of a business is an opportunity to move both themselves and their company toward a new stage of life, will be best prepared to execute a successful business transition. This newsletter is written to help owners think through the ‘big picture’ and align their thinking and resources towards a successful exit.

The Transfer Timing Slots

One of the first ‘big picture’ concepts that owners should grasp is the idea of ‘timing slots’. Much like a slot machine, you want to see if you can match up three (3) critical areas – (1) personal timing, (2) company preparedness, and (3) market timing. A solid ‘big picture’ of an exit considers all three.

Let’s Begin with Market Timing

Markets run in cycles and timing is important. If a business is performing well because there is a favorable economy, all things being equal, this can be an optimal time to consider an exit. Valuation is high, employees are engaged, and – often times – buyers / investors have a high degree of interest and activity.

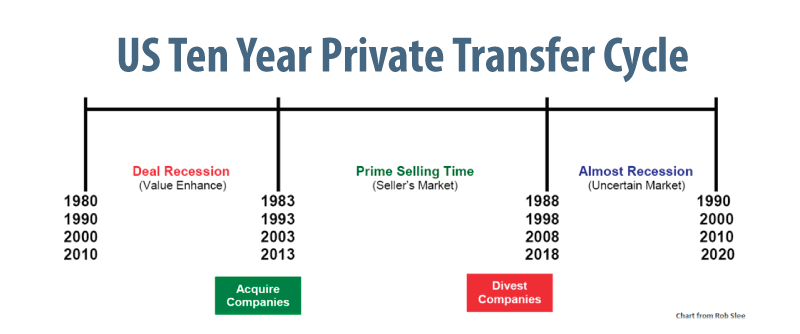

As the chart below indicates, the last three (3) decades have followed a similar market cycle and this decade is following suit.

Therefore, if you believe the information above, your ‘big picture’ in terms of market timing indicates that the next few years are ideal in terms of market timing.

Company Preparedness

The 2nd ‘big picture’ concept for an exit is Company preparedness. In other words, your business needs to be [at least somewhat] transferrable to have a successful exit.

There are a large number of items that can lead to poor timing for an exit and lack of company preparedness. For example, you may have recently had a departure of a key manager or you may have lost a key customer and need time to replace that revenue. Alternatively your CFO or controller may not have your finances in order or you may have a law suit pending that should really be resolved before moving ahead with a transfer of the business.

While timing can rarely ever be perfect, it is important to think through the current and forecasted profitability and valuation to see that your company’s preparedness is optimal for a successful transaction that will result in a valuation and deal structure that works for you personally.

Personal Timing

The final ‘big picture’ concept – and the third consideration in the timing slots of an exit – is personal readiness. In fact, it probably makes sense to begin the ‘big picture’ thinking of an exit with personal planning. The reason is that this can be the most complex and take the most amount of time to navigate. Also, how an owner thinks about an exit is what is most likely to drive the exit process. In other words, the market and company can be perfectly positioned for an exit, but if the owner does not want to leave, it is possible that an exit process will not begin.

A Vision for a Personal Future Without the Company

Prior to considering any of the various options for exiting your business, you must be able to recognize two key elements within yourself:

- Realization of where you are right now, and

- A clear vision of where you want to be after the exit

As a successful business owner, you realize that you have created self-worth and profit for both the company and those around you, including your family members. In building a company, you have built a personal identity, perhaps the only one which is recognized by some family, friends, and business associates. Many owners, without properly considering their new, post-exit identities will be unable to successfully pursue a business exit because of their continued attachment to the business. In order to ensure a smooth transition, you want to be able to articulate both where you are in your business today and the personal challenges associated with getting you to where you want to be.

Developing Exit Skills

The key to achieving the vision – or the ‘big picture’ – for your exit is an understanding that the tools and skills which have enabled you to build your business will likely be of limited value in planning your exit from the business; you’ll need to learn new skills. If you are using the same tools, skills and thoughts that you used to run and grow your business, it is very difficult to move on to the next phase. The primary reason why this is true is that the development of business value is not entirely consistent with the development of fulfilling personal needs and values.

A ‘big picture’ look at your situation will have you begin to ask questions about ‘why’ it is important to design an exit plan that meets the needs that you have defined.

Concluding Thoughts

Seeing the “big picture” in your exit involves taking the time to reflect on goals of the business, the timing of the market, but most importantly, your interests and objectives outside of the business. Exploring your personal goals allows you to confidently move forward to the next phase of life, which may or may not include continued involvement with the company. As in so many aspects of one’s life, perspective is key to ultimate success. By viewing your exit as an opportunity to a begin a new lifestyle instead of as a loss of your business identity, you can begin develop a ‘big picture’ for your exit.

We hope that this newsletter helps you to understand the complexities of an exit decision and transaction and inspires you to begin your planning today.

Read more more about our exit planning services.

by phone (201) 632-2048 or email at rpavese@wpsllc.net.