March 13, 2023

From the desk of Kara Murphy1, CFA

Is the Banking System at Risk?

On March 10, the Federal Deposit Insurance Corporate (FDIC) officially took over Silicon Valley Bank in order to protect depositors, marking a remarkably swift end to a bank that had been in business for four decades. Then on March 12, Signature Bank, based in New York City was also taken over by regulators. Collectively, those banks held over $250 billion in client deposits.

On March 10, the Federal Deposit Insurance Corporate (FDIC) officially took over Silicon Valley Bank in order to protect depositors, marking a remarkably swift end to a bank that had been in business for four decades. Then on March 12, Signature Bank, based in New York City was also taken over by regulators. Collectively, those banks held over $250 billion in client deposits.

The event brought me back to my days as a stock analyst covering the bank and mortgage sector during the global financial crisis, when Monday mornings would often be met with a list of newly failed banks that had been taken over by teams from the FDIC. This time around, however, there are important differences between these failures and those in 2008. In addition, the failures have been met with even swifter action from federal regulators.

What happened to Silicon Valley Bank?

Silicon Valley was the second bank to run into trouble recently. Silvergate Capital, a bank focused on crypto businesses, was the first crack to show. The stock peaked at $222 in November 2021. After multiple crypto-related failures and accusations of fraud among its clients, the stock is now down 99% from that peak. Silvergate’s fall from grace was largely seen by the banking industry as an isolated situation. The bank was heavily focused on the crypto industry, lending against digital assets that then fell significantly in value.

Silicon Valley Bank (SVB), while different in many ways from Silvergate, could also be seen as a relatively isolated situation. SVB had long focused on banking businesses and individuals in the innovation economy, including venture capital, private equity, technology companies and, yes, crypto. That meant lending to funds and businesses, taking their deposits and providing wealth management services to its principals. In addition, SVB would make investments in these funds with the bank’s capital.

To understand the root causes of Silicon Valley Bank’s downfall, we first have to go back to the early days of the pandemic. During that time, many of SVB’s clients were flush with cash that found its way into bank deposits. This phenomenon was felt throughout the banking industry as bank coffers swelled. A bank such as SVB would normally look to use new deposits to make new loans. But in the midst of the global pandemic, few loans were being written, and SVB instead invested those deposits in bonds at a time when yields were extraordinarily low.

Fast forward three years, yields have increased significantly, driving the value of those bonds lower. This in itself is not a concern for banks – they can own bonds that decline in value, as long as they are able to hold them until those bonds mature. SVB, however, did not have that luxury.

As the funding environment became more difficult for the venture firms, many of SVB’s clients started using their deposits. In order to redeem those deposits, the bank had to start selling some of those bonds that had fallen in value, realizing those losses and hurting their capital ratios.

SVB might have been able to manage through the immediate challenge but then large clients, concerned about the strength of the bank, pulled more money out of the bank and encouraged others to do so as well. A downward psychological spiral took hold and a bank run began that even Jimmy Stewart wouldn’t have been able to stem.

What about Signature Bank?

While SVB’s failure was announced mid-day on Friday (an unusual move – regulators normally wait until a weekend to make such an announcement), news of Signature Bank’s failure hit on Sunday afternoon. While details of Signature’s troubles remain scant, they likely faced similar challenges to SVB. The bank also focused on private businesses, saw deposits swell during Covid, and has more recently experienced outflows.

Both banks also had very large portions of their deposits uninsured, meaning that depositors had accounts valued well above the limit of $250,000 that the FDIC will insure. This point was critical – because these banks’ customers could not count on the FDIC to make them whole, they were much more likely to withdraw their funds at the first sign of the bank wobbling. Then those early withdrawals quickly became a self-fulfilling prophecy, creating a stampede of deposits out the door.

What about other regional banks?

Other regional banks have confronted many of the same challenges as SVB and Signature – swelling deposits with limited loan growth, followed by rising interest rates and deposit outflows. What was unique to SVB was the magnitude of these challenges. Silicon Valley Bank’s deposits grew by about 200% compared to pre-pandemic levels, then declined by 10% in 2022 with additional declines earlier this year.

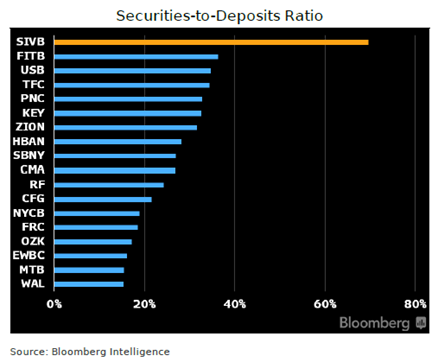

Those excess deposits found their way to securities to a much greater extent than other banks. SVB’s bonds relative to deposits was a remarkably high 70%, compared to an average for regional banks at just 27%. This higher relative exposure to bonds (as opposed to loans) left them more vulnerable to dropping bond values.

SVB, Signature and Silvergate also all had exposure to cryptocurrencies and related businesses. While Silvergate focused primarily on crypto and other fintech related businesses, Signature had nearly one quarter of its deposits with crypto-related assets and companies. Many of SVB’s customers were crypto-related businesses. These banks failures are a clear instance of crypto risks bleeding into traditional finance.

What are regulators doing?

Over the weekend, the Federal Reserve, US Treasury and FDIC made two key announcements:

- They will guarantee ALL deposits of the affected banks

- They are providing lending to banks, valuing their bonds at par

Together, these measures likely would have stemmed the bank runs at Signature and SVB. While they won’t save those banks, they are clearly intended to prevent bank runs elsewhere and shore up confidence in the banking system.

While this is a bailout for depositors, it will be paid for by other banks, and any equity holders and unsecured debt holders have been wiped out. In addition, the customers of the specialized businesses that these banks focused on will likely have a hard time finding other banks to do business with.

Is my savings account at risk?

The American banking industry is carefully calibrated to protect individual depositors. The FDIC, in fact, was developed in the wake of the Great Depression to ensure that bank customers could get their money out even in the event of a run on the bank. Customers of both SVB and Signature are able to access their funds as of Monday morning, despite these banks failures. Keep in mind that the amount the FDIC insures remains limited for other banks, so we would encourage individuals who are concerned to verify whether their full deposits are covered.

We’ll continue to monitor the situation closely.

Invest wisely and live richly,

Kara

1 Kara Murphy, CFA is not affiliated with or an employee of Wealth Preservations Solutions, LLC., or Kestra Advisory Services, LLC. Kara is affiliated with Kestra Investment Management, LLC, an investment adviser registered with the Securities and Exchange Commission. Kestra IM is an affiliate of Kestra Holdings. The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice.